quickloanemi.com – When it comes to making smart financial decisions, understanding the real cost of borrowing versus saving is crucial. Should you take a traditional car loan, or would leveraging your fixed deposit (FD) be the more cost-effective choice?

In this blog, we break down the interest rates, hidden charges, and financial implications of both options. Learn how banks structure their loans, how FD-backed loans compare, and which strategy helps you maximize savings while minimizing debt.

Discover the pros and cons, expert tips, and real-world examples to guide your next big financial move. Stay informed and make the right decision for your future!

Would you like me to add SEO-friendly keywords or format it differently? 🚗💸

1. Introduction: The Core Dilemma

When financing a car purchase, most buyers face two primary options:

- Traditional Car Loan (8-12% interest)

- Loan Against Fixed Deposit (FD rate + 1-2%)

This guide provides a detailed, data-driven comparison across 10 key parameters to help you make an informed decision.

2. How Each Loan Works: Mechanism Comparison

2.1 Loan Against FD

- Type: Secured overdraft facility

- Loan Amount: Up to 90% of FD value

- Interest Calculation: Daily reducing balance

- Repayment: Flexible (interest-only or principal+interest)

- Example: ₹5L FD → ₹4.5L loan available

2.2 Car Loan

- Type: Secured term loan

- Loan Amount: Up to 100% of car value

- Interest Calculation: Monthly reducing balance

- Repayment: Fixed EMIs

- Example: ₹5L car → ₹5L loan possible

3. Interest Rate Breakdown

3.1 Current Market Rates (2024)

| Bank | FD Rate (5Y) | FD Loan Rate | New Car Loan Rate |

|---|---|---|---|

| SBI | 6.50% | 7.75% | 9.20% |

| HDFC | 7.00% | 8.50% | 9.75% |

| ICICI | 6.75% | 8.25% | 10.00% |

3.2 Effective Interest Calculation

FD Loan Net Cost = (FD Loan Rate) – (FD Earnings)

= 8.5% – 7.0% = 1.5% effective interest

Car Loan Net Cost = Full interest rate (no offset)

= 9.75%

4. Detailed Cost Comparison (₹5L, 5 Years)

4.1 Loan Against FD

- Loan Amount: ₹4,50,000 (90% of ₹5L FD)

- Interest Paid: ₹1,08,000

- FD Interest Earned: ₹1,92,500

- Net Gain: ₹84,500 (FD earnings exceed loan interest)

4.2 Car Loan

- Loan Amount: ₹5,00,000

- Interest Paid: ₹1,47,000

- Processing Fee: ₹5,000 (1%)

- Total Cost: ₹1,52,000

Savings with FD Loan: ₹2,36,500 (₹84,500 gain vs ₹1,52,000 cost)

5. Hidden Cost Analysis

5.1 Loan Against FD

| Charge | Typical Cost | Impact |

|---|---|---|

| Foreclosure Fee | 1-2% | ₹4,500-₹9,000 |

| Minimum Balance Penalty | 0.5% p.a. | If FD falls below threshold |

5.2 Car Loan

| Charge | Typical Cost | Impact |

|---|---|---|

| Processing Fee | 0.5-2% | ₹2,500-₹10,000 |

| Prepayment Penalty | 2-5% | ₹10,000-₹25,000 |

| Mandatory Insurance | 10-15% extra | ₹5,000-₹7,500/year |

6. Flexibility Comparison

6.1 Repayment Options

| Feature | FD Loan | Car Loan |

|---|---|---|

| Partial Payments | Yes | No |

| EMI Holidays | Yes (up to 6 months) | No |

| Tenure Change | Anytime | Difficult |

| Foreclosure | 1-2% fee | 2-5% fee |

6.2 Liquidity Impact

- FD Loan: FD remains locked but earns interest

- Car Loan: No asset locking but higher cash outflow

7. Credit Score Impact

7.1 Loan Against FD

- No credit check required

- Not reported to credit bureaus

- No impact on credit utilization ratio

7.2 Car Loan

- Hard inquiry during application

- Affects credit mix (installment loan)

- Payment history affects score

8. Tax Implications

8.1 Loan Against FD

- Interest Paid: Deductible if used for business

- FD Interest: Fully taxable (TDS if >₹40,000)

8.2 Car Loan

- No tax benefits for personal use

- Business use: Interest deductible as expense

9. Special Scenarios

9.1 If You Break the FD

- Lost Interest: Typically 0.5-1% penalty

- Tax Impact: TDS on accrued interest

9.2 Used Car Purchase

- FD loans often better as car loans cost 12-18%

9.3 Short-Term Need (1-2 Years)

- FD loan clearly superior due to flexibility

10. Bank-Specific Offers

10.1 Best FD Loan Deals

- SBI: 0.5% above FD rate for salary account holders

- HDFC: 1% discount for Imperia banking customers

10.2 Best Car Loan Deals

- Axis Bank: 8.75% for electric vehicles

- BOB: 0.25% discount for government employees

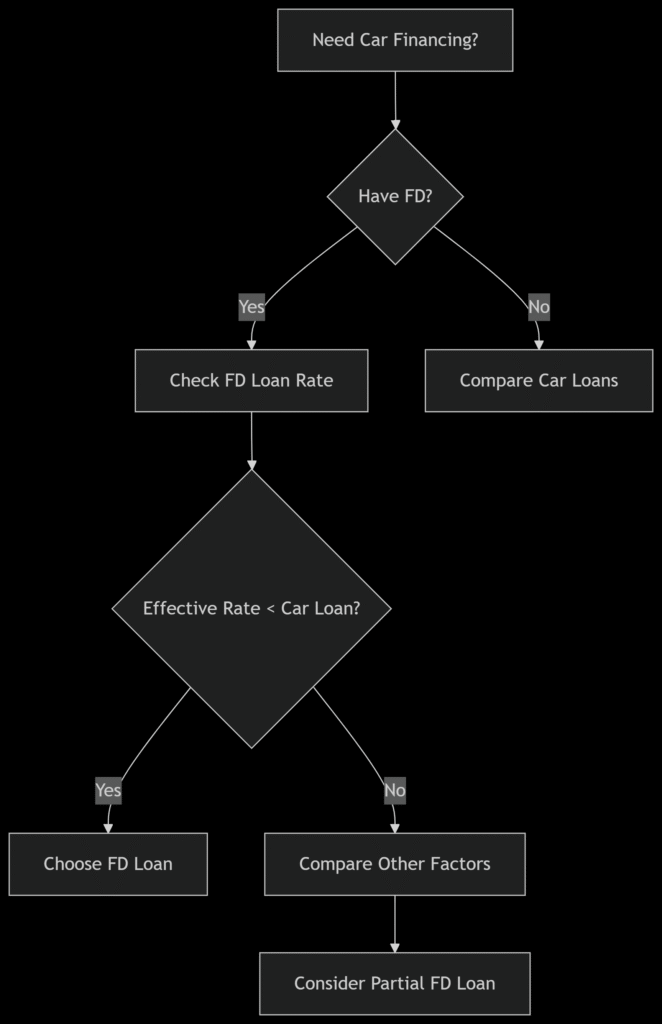

11. Decision Flowchart

12. Pro Tips for Maximum Savings

- Negotiate FD Loan Rates: Most banks offer 0.25-0.5% discount

- Time Your FD Maturity: Align repayment with FD renewal

- Hybrid Approach: Use 50% FD loan + 50% car loan

- Prepay Strategically: Use FD maturity to close car loan early

13. FAQs (Questions)

- Can I take a car loan against my FD?

Yes! Many banks allow you to use your FD as collateral to get a car loan at a lower interest rate. - What is the interest rate difference between a car loan and a loan against FD?

A car loan typically has an interest rate of 9% to 12%, while a loan against FD is usually 2% to 3% higher than the FD interest rate. - How much loan can I get against my FD?

Banks generally offer 70% to 90% of the FD amount as a loan. - Do I continue earning interest on my FD if I take a loan against it?

Yes! Your FD continues to earn interest even after you take a loan against it. - Is there a processing fee for a loan against FD?

Many banks do not charge a processing fee for loans against FD, whereas car loans may have a small fee. - Which is better: a car loan or a loan against FD?

- A car loan is a term loan with fixed EMIs and is sensitive to repo rate changes.

- A loan against FD is often an overdraft facility, offering flexibility in repayment but requiring renewal.

- Are there foreclosure charges for a loan against FD?

Most banks do not charge penalties for early repayment of loans against FD.

14. Final Recommendation

Choose FD Loan If:

- You have an FD with 3+ years remaining

- You want lower net interest cost

- You value repayment flexibility

Choose Car Loan If:

- You need 100% financing

- Your FD rates are very low (<5%)

- You want to maintain FD liquidity

Savings Potential: ₹50,000-₹2,00,000 on ₹5L loan over 5 year